For over 30 years, Werner South Africa Pumps & Equipment (PTY) LTD has been designing, manufacturing, supplying and maintaining specialist...

VISIT SHOWROOM

For over 30 years, Werner South Africa Pumps & Equipment (PTY) LTD has been designing, manufacturing, supplying and maintaining specialist...

VISIT SHOWROOM

For over 30 years, Werner South Africa Pumps & Equipment (PTY) LTD has been designing, manufacturing, supplying and maintaining specialist...

VISIT SHOWROOM

For over 30 years, Werner South Africa Pumps & Equipment (PTY) LTD has been designing, manufacturing, supplying and maintaining specialist...

VISIT SHOWROOM

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated May 30, 2025...

8 August 2025: BHP Group and Vale have reportedly offered about $1.4 billion to settle a UK class action linked...

MIAMI, May 15, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (Nasdaq: DGXX /...

Australia’s standing as a top-tier destination for mining investment has taken a significant hit, with the latest Fraser Institute Survey...

MIAMI, May 22, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (Nasdaq: DGXX /...

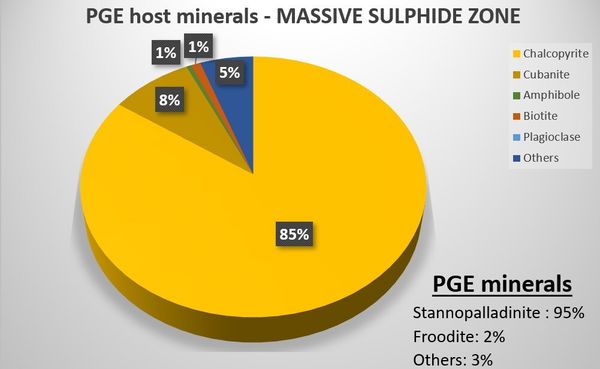

TORONTO, July 14, 2025 Power Metallic Mines Inc. (the "Company" or "Power Metallic") (TSXV: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV) Power...

4th August 2025 SANTIAGO - All five workers at Chile's El Teniente copper mine who were trapped in a collapse...

4th August 2025 US Trade Representative Jamieson Greer sounded a cautiously optimistic note on discussions with China on rare earth flows, following...

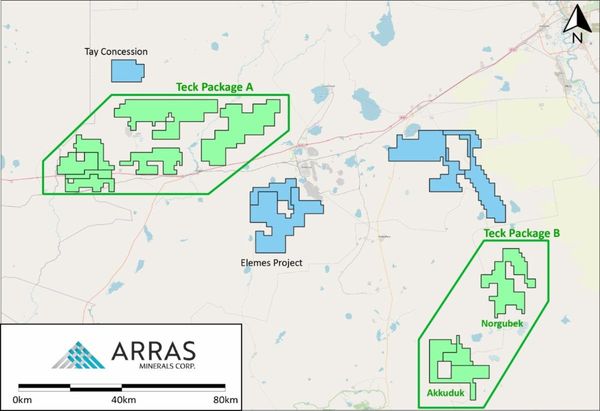

Vancouver, British Columbia – Arras Minerals Corp. (TSX-V: ARK, OTCQB: ARRKF) (“Arras” or “Arras Minerals” or “the Company”) is pleased...

4th August 2025 Oil and gas producer Santos on Monday said it will supply utility firm Engie with up to...

MIAMI, Aug. 04, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (Nasdaq: DGXX /...

8 August 2025: Koryx Copper has released an updated preliminary economic assessment for its Haib copper project in southern Namibia,...

BHP and Vale are facing a London lawsuit from the law firm representing hundreds of thousands of people over Brazil's...

MIAMI, July 28, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (NASDAQ: DGXX /...

MIAMI, April 01, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (Nasdaq: DGXX /...

MIAMI, May 01, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (Nasdaq: DGXX /...

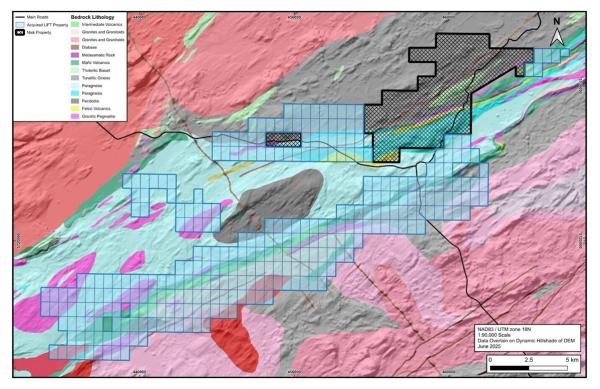

Phenom Resources Corp. (TSX-V: PHNM) (OTCQX®: PHNMF) (FSE: 1PY0) (“Phenom” or the “Company”) is pleased to report for the...

MIAMI, July 23, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("DGXX" or the "Company") (Nasdaq: DGXX / TSXV: DGX),...

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated May 30, 2025...

MIAMI, March 26, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (Nasdaq: DGXX /...

8 August 2025: The fatal collapse at Codelco’s El Teniente mine in Chile, which killed six workers, was likely caused...

Top White House officials told a group of rare earths firms last week that they are pursuing a pandemic-era approach...

TORONTO, July 23, 2025 - Power Metallic Mines Inc. (the "Company" or "Power Metallic") (TSXV: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV)...

4th August 2025 Informal miners in Peru suspended talks with the government and may resume protests due to disagreements in...

MIAMI, March 31, 2025 (GLOBE NEWSWIRE) -- Digi Power X Inc. ("Digi Power X" or the "Company") (Nasdaq: DGXX /...

8 August 2025: Australian critical minerals producer IGO has announced the resignation of non-executive director Justin Osborne, effective 15 August,...

31 July 2025: Mining input costs in South Africa remained subdued in May, with the Mining Cost Index rising just...

SANTIAGO – Moody's Ratings affirmed the credit rating of Chilean lithium miner SQM but lowered its outlook to negative from...

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated May 30, 2025...

Gold miner Ramelius Resources has completed its acquisition of Spartan Resources by way of a scheme of arrangement, positioning the...

5th August 2025, Australian rare earths producer Lynas Rare Earths is well-positioned to meet the growing demand from a maturing...

8 August 2025: Australian miner Fortescue has obtained a 14.2-billion yuan ($1.98 billion) syndicated term loan from Chinese, Australian and...

11 August 2025: Capstone Copper has approved construction of its Mantoverde Optimised project in Chile after securing all board and...

11 August 2025: Chinese battery manufacturer CATL has suspended operations at its Yichun lithium mine in Jiangxi province after its...

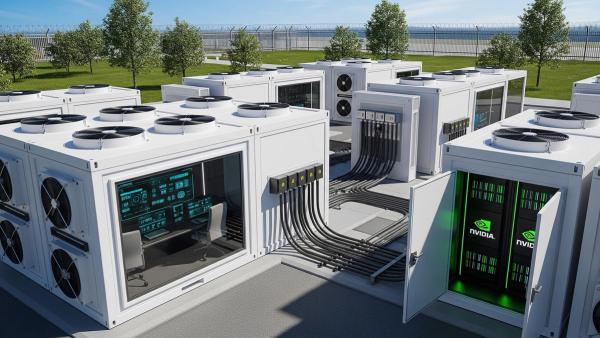

The next wave of artificial intelligence infrastructure won’t come from tech giants alone—but from nimble operators who already own the...

4th August 2025 Top iron-ore producer Vale continues to weigh an investment in Eurasian Resources Group’s Brazilian mine project, but...

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated May 30, 2025...

PRE-OPEN Futures are again higher as investors looked for tariff negotiations between U.S. and its trading partners with focus on the...

29 July 2025 Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF) is pleased to announce that it is expanding...

4th August 2025 Gold’s historic price surge has opened the door to margin expansion for producers, but Australian gold and...

4th August 2025 ASX-listed companies Mineral Resources (MinRes) and Dynamic Metals have revised the terms of their lithium-focused joint venture...

TORONTO, June 9, 2025 - Power Metallic Mines Inc. (the "Company" or "Power Metallic") (TSXV: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV)...

Super Micro Computer (NASDAQ:SMCI) stock is trading upwards on Monday, akin to its semiconductor peers. This coincides with reports indicating...

Flying deep into the heart of Western Australia, Rio Tinto Group executives, politicians and media step off a chartered jet...

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated May 30, 2025...

4th August 2025 ASX-listed Arizona Lithium has announced a nonbinding memorandum of understanding (MoU) to develop a dedicated transload facility...

The next wave of artificial intelligence infrastructure won’t come from tech giants alone—but from nimble operators who already own the...

PRE-OPEN Futures are again higher as investors looked for tariff negotiations between U.S. and its trading partners with focus on the...