Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC) has announced positive results from its re-assays on the Philadelphia epithermal gold project. The re-assays were carried out by the metallic screen procedure on selected drill hole intervals. The highest grade interval showed the largest grade increase at 42.2% (51g/t to 72.5g/t) gold. 24 samples, all from the reverse circulation drilling campaign from spring of 2023, of high- and low-grade material were re-assayed if they contained visible gold.

According to Greg Hahn, the Vice President of Exploration at Arizona Silver, “Re-assaying of samples with coarse gold is a normal industry practice to gauge if grades are being underestimated simply because a standard 30-gram sample for fire assay can miss coarse gold that might not be represented in a 30-gram split. Re-assaying on 24 samples is considered statistically meaningful as we assayed both higher and lower-grade material. For all 24 samples, the average grade increased by 25.9%.”

Metallic screen assays and duplicate re-assays were run to assess the potential for coarse gold that is not adequately represented in standard 30-gram fire assay analyses. The results show the high-grade intervals contain coarse gold. The results show a dramatic grade increase for samples with initial grades of about 4-5g/t gold. The highest-grade sample, found in drill hole PRC23-97, returned a grade of 72.5g/t gold in metallic screen analyses, which is a 42% increase from the initial 51g/t gold findings.

For that sample, grades of 65 and 74.8g/t gold were returned upon re-assaying the original sample using a larger pulp size.

Chris Temple, editor of The National Investor, has noted that Arizona Silver’s past results from its reverse circulation drilling have been “uber exciting.”

The results of the metallic screen analyses and re-assaying using a larger pulp compare with each other favorably, suggesting that re-assaying by metallic screen should be recommended, especially when discrepancies exist in standard assaying and re-assay sampling.

The metallic screen analysis and re-assaying exercise of the sample selected resulted in a 25.9% increase in the average grade of the sample suite. The usual discrepancies between metallic screen analyses and re-assaying of low-grade samples are about 0.5g/t gold, mostly less than 0.1g/t gold. This suggests that coarse gold is not an issue in lower-grade samples.

Greg Hahn said, “Going forward, we will routinely re-assay high-grade intervals and use the metallic screen technique also on duplicate samples to resolve potential assay discrepancies when our geologist identifies coarse gold in his logging. In due course, when Philadelphia advances into the evaluation phase, much more re-assaying will be done. In the meantime, I am delighted that our project continues to have positive outcomes as we continue drilling off this deposit.”

Ready for Another Rally

According to Richard Mills of Ahead of the Herd, precious metals are due for another rally that could see values shooting up from US$12,000 to US$15,000 per ounce. There are a number of major factors pushing gold up, including central bank buying and a weakening dollar.

Barry FitzGerald cited many of the same factors while making a case for the rise of gold last month. A strained economy prompts many investors to turn towards gold as a safe haven.

A History of High Performance

Chris Temple, editor of The National Investor, has noted that Arizona Silver’s past results from its reverse circulation drilling have been “uber exciting.”

According to Temple, “AZS shares had already been better-than-average performers among the universe of exploration juniors that haven’t been able to get out of their own way for many months, despite the occasional — and current — spike in gold’s price especially.” Temple puts this success down to strong leadership and shareholders who know they are holding out for a big break.

Technical Analyst Clive Maund rated “Arizona Silver as an immediate strong speculative buy for all timeframes.” Maund also maintains that Arizona Silver is on the edge of a big break.

Technical Analyst Clive Maund rated “Arizona Silver as an immediate strong speculative buy for all timeframes.” Maund also maintains that Arizona Silver is on the edge of a big break.

Arizona Silver has a tight share structure and an extremely low burn rate. The Philadelphia project is expanding, and the company is expecting pending drill results at any time. The company has a rate of 100% drill hole hits on all patented ground drilling since 2021 and minable grades.

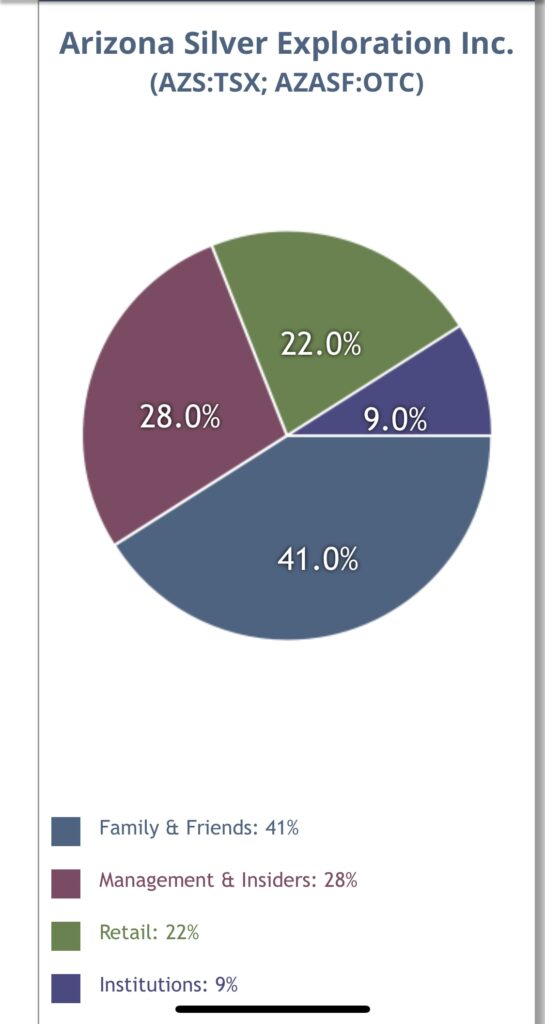

Ownership Information

Brady Stiles owns 14.89% of the company with 10.62 million shares, Gregory A. Hahn owns 5.31% with 3.79 million, Mike Stark owns 3.71% with 2.46 million, David John Vincent owns 1.75% with 1.25 million, Dong Hyun Shim owns 1.27% with 0.90 million, Eugene Spiering owns 0.09% with 0.06 million, and James B. Engdahl owns 0.07% with 0.05 million.

SSI Wealth Management AG owns 9.03% with 6.45 million shares, and Moloney Securities Asset Management LLC owns 0.01% with 0.01 million shares.

The company reports no strategic investors, though it does claim to have a large following of family and friends.

Arizona Silver has a monthly burn rate of CA$24,000, and a monthly drilling cost of CA$50 in core and CA$35 per foot in RC.

The company does not see any potential sellers or warrants overhang.

Arizona Silver does not currently work with any IR firms or influencers. John Kaiser, Chris Temple, Jeff Clark, and Michael Fox all provide news coverage of the company.

There are 71.35 million shares outstanding, and 52.02 million free-float traded shares. The company has a market cap of US$16.92 million. It trades in the 52-week period between US$0.17 and US$0.59.

Source :- https://www.streetwisereports.com/article/2023/07/17/silver-companys-re-assay-results-reveal-more-gold-than-expected.html