TheGoldAdvisor is adding copper-gold stocks to the portfolio. They are copper dominant assets, but also have some gold. And ones that compel me to invest now.

But Jeff, we’re staring at the teeth of a recession!

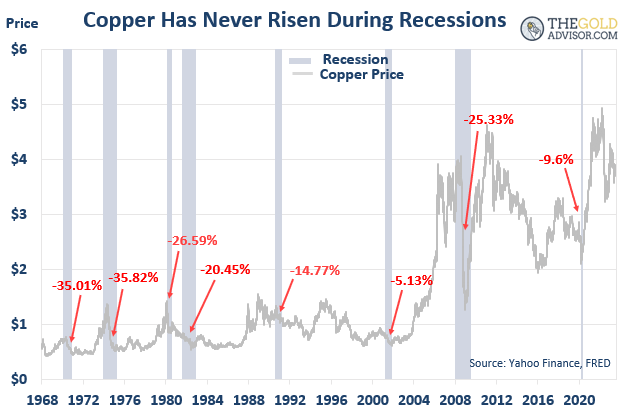

Yes, we are. A point we must consider since the copper price has fallen in every recession since the 1960s.

This isn’t surprising because a slowing economy lowers demand for base metals including copper.

But as I’ll explain, I’m not recommending the metal copper. And in the big picture, the supply/demand imbalance will soon reach critical levels, recession or not.

First, the big picture. As investors probably know, copper is essential for…

- Electrification. Copper has the highest conductivity (other than precious metals) for electricity, which means the electricity isn’t lost in transit. The power grid itself—which in many cases needs updated—uses a lot of copper.

- Electric Vehicles. Did you know that copper is used much more in EVs than traditional cars or in fossil fuel plants? An EV car requires roughly 4x more copper than the internal combustion engine (ICE) car, and twice as much copper as a coal plant.

- Windmills. Surprisingly, wind systems have the highest copper content of all renewable energy technologies. A single wind farm can contain from 2,000 to 7,000 TONS of copper.

- New technologies. Even though 5G is wireless, copper cable is needed to connect equipment, and build base stations and data centers. Even Artificial Intelligence uses copper.

- Emerging economies like China and India need copper for infrastructure, construction projects, and electrical wiring.

And that’s the first thing we want to be aware of:

The fundamentals for this critical metal are overwhelmingly positive. That’s reinforced by the near frenzy of companies scrambling to find new sources of copper supply. Rio Tinto, Glencore, BHP, and Newmont all recently bought copper projects—they know a recession is coming, but they’re investing now anyway.

Analysts have different projections of when supply will not be able to meet demand, but the future is clear: even with a recession, a shortfall is coming. One analyst said that by 2030 we’ll be short by over 5 million tonnes. The research arm of Bloomberg projects demand will rise every year until 2036. And global demand for refined copper is expected to be almost 30 million tonnes per year by 2026. There’s a lot more that could be said here, but it seems I can’t go a week without reading another article about the coming shortfall in copper.

There’s another critical point to make about the coming supply shortfall. To start new mines, the copper price will need to be materially higher. Some analysts think the price must double. Think about it… if you’re the CEO of a copper project, are you going to start a mine if you can’t make a profit, even if your product is in high demand? This isn’t to say the copper price will rise in a recession, but that the long-term price must rise significantly to get new projects into production. In fact, Deutsche Bank estimates it will take 10 years to get to production if applying for a permit today.

But perhaps the biggest reason is because of governments. It doesn’t matter what you might think about the amount your government spends, but it’s clear that many politicians around the world have a near obsession with going green. They’re going to fund green energy projects, even in a recession—maybe even more if it’s a hard landing… recall the workforce programs we saw in the Great Recession, for example.

Love it or hate it, the Inflation Reduction Act of 2022 is the most significant climate legislation in U.S. history. This new tax law will pump BILLIONS of federal funds into green energy projects, to accelerate the transition from a fossil fuel society to a clean energy economy, all of which require copper. And most provisions just became effective on January 1 this year.

On top of that, the US Department of Energy (DOE) just two weeks ago officially added copper to its Critical Materials list, the first time a US government agency has included copper on one of its official “critical” lists. The European Union, Japan, India, Canada, and China all have similar provisions.

Heck, my wife and I got several financial incentives to switch to solar power, one of which amounted to a couple thousand dollars. And it didn’t cost us anything to switch—what business wouldn’t take advantage of a similar offer? They aren’t all structured this way, but you can bet the government will be throwing dump trucks of money at this. Bottom line, you can’t go green without copper. (And silver.)

Okay Jeff, I get it. But shouldn’t we wait till after the recession?

No. At least not for the stocks I will recommend.

To be clear, I do expect the copper price to fall in the coming recession, whether it’s this year or next, along with most copper majors. However…

- The companies invited to TheGoldAdvisor will be at a critical point in their development, ones I’m recommending for a specific reason, at a specific time. Think company discovery and development, not metal price.

A good example of the disconnect between the metal and a company stock price is Snowline Gold… the gold price went nowhere last year, and most mining stocks were down big, but Snowline made a discovery and is up 676% since I first recommended it in October 2021.

Copper plays are the same. A discovery, or big expansion, or mine start-up can spark a run in the stock, almost regardless of the environment. The ones I’ll recommend will be at one of those junctures.

Further, all the recommendations will have gold in them, too. There’s a specific reason for that:

- Deposits that carry both copper and gold are especially attractive and are being actively sought.

The gold in many cases will actually be the byproduct, its revenue used to reduce the cost to mine the copper. Either way, these deposits are generally speaking more attractive than pure copper plays.

Our recommendations in this area will meet these criteria—they will include gold and be at a compelling point to buy, with potential catalysts dead ahead.

Our first pick here is in the middle of the company’s biggest drill campaign ever, with drill results imminent, any of which could be a game-changer for the company. The stock is deeply undervalued to boot.