Canada’s main stock index futures rose, supported by strong oil and gold prices. Wa

COMPANIES & NEWS

XORTX Therapeutics Inc. (NASDAQ: XRTX | TSXV: XRTX | Frankfurt: ANU), a late stage clinical pharmaceutical company focused on developing innovative therapies to treat progressive kidney disease, is pleased to announce that the pre-Phase 3 meeting request made to the US Food and Drug Administration (“FDA”) has resulted in the grant of a virtual meeting scheduled on September 16, 2022. In advance of this meeting, XORTX has submitted a “Pre-Phase-3 Briefing Package” to the FDA on Thursday, July 28, 2022.

To date, the Company has successfully completed the research and development activities leading to this request and is advancing its XRx-008 program for the treatment of autosomal dominant polycystic kidney disease (“ADPKD”). R&D activities during the past year leading to this meeting request included manufacturing clinical quality GMP oxypurinol, finalizing formulation of drug product, and characterizing improved oral bio-availability of oxypurinol in animal models. The Company has achieved successful regulatory filings with the FDA and Health Canada and has commenced its OXY-XRX-101 bridging pharmacokinetics study. These important milestones have well positioned XORTX for this pre-Phase 3 meeting with the FDA.

The Pre-Phase 3 Briefing Package provides an up-to-date summary of the extensive work completed for the XRx-008 program and this type B meeting. In addition, the briefing package presents an agenda including topics and questions for discussion related to the critical developmental steps necessary to complete the planned clinical registration trial and for the marketing approval application.

Dr. Allen Davidoff stated, “We are pleased to advance the XRx-008 program with this filing and establish a meeting date with the FDA. We believe the discussions with the FDA will clarify the optimal, key clinical steps needed in advance of filing a US marketing application new drug approval (NDA) toward discussions with the FDA and to advance the XRx-008 program.”

MariMed Inc. (CSE: MRMD), a leading multi-state cannabis operator focused on improving lives every day, today announced the availability of a new and scrumptious cannabis-infused ice cream. MariMed collaborated with the legendary Boston ice cream brand Emack & Bolio’s® to develop and market new and innovative vegan and dairy ice cream in outrageous flavors. The ice cream is an extension of MariMed’s top-selling and award-winning Betty’s Eddies infused fruit chews brand and shares the brand’s commitment to being hand-crafted and using all-natural ingredients.

Strategic Resources Inc. (TSXV: SR), announced that it has been granted an extension to a previously issued water permit that was set to expire in July 2022. An application to extend the existing water permit allowing for future construction of mining operations at Mustavaara was delivered to the Regional State Administrative Agency for Northern Finland (“PSAVI”) in February 2022. On June 21, 2022, PSAVI approved the application to extend the permit for three years until July 2025. The approval was open for public appeals to the Regional Court until July 28, 2022. No appeals were made, and the permit is now legally binding.

Signal Gold Inc. (TSX: SGNL) announced Wednesday that it has been advised by the Nova Scotia Minister of Environment and Climate Change that the Goldboro gold project has been approved.

Imperial Mining Group Ltd. (TSXV: IPG),Thursday, August 4th @9AM EST (9-920 AM EST) — InvestorTalk.com with Peter Cashin

The Bank of England raised interest rates by the most in 27 years this morning, despite warning that a long recession is on its way, as it rushed to smother a rise in inflation which is now set to top 13%. Reeling from a surge in energy prices caused by Russia’s invasion of Ukraine, the BoE’s Monetary Policy Committee voted 8-1 for a half percentage point rise in Bank Rate to 1.75% – its highest level since late 2008 – from 1.25%. The 50-basis-point increase had been expected by most economists in a Reuters poll as central banks around the world scramble to contain the surge in prices. In its new forecasts, the BoE saw inflation falling back to 2% in two years’ time as the hit to the economy took its toll on demand. Governor Andrew Bailey told a news conference that the risks to the BoE’s outlook were “exceptionally large”.

Home prices in the Greater Toronto Area (GTA) fell for the fifth straight month in July, as rapidly rising interest rates further doused the city’s once-red-hot housing market, data from the Toronto Regional Real Estate Board (TRREB) showed.

Bombardier Inc: The business jet maker reported a smaller second-quarter loss, helped by steady demand from wealthy travelers and lower interest expenses. The company’s adjusted loss per share narrowed to 48 cents per share, from a loss of $1.49 per share a year earlier. Revenue rose to $1.56 billion from $1.52 billion for the quarter ending June 30. Bombardier now expects 2022 free cash flow of more than $515 million, compared with its earlier forecast of over $50 million, in part due to an increase in working capital.

Canadian Natural Resources Ltd: The company reported a quarterly profit that more than doubled, as crude prices soared on tighter energy supplies due to the Ukraine conflict. Canadian Natural Resources said its average realized price for oil rose 88.3% to C$115.26 per barrel in the April-June quarter. The company posted net earnings of C$3.5 billion, or C$3 per share, for the second quarter, compared with C$1.55 billion or C$1.30 per share, a year earlier.

Nutrien Ltd: The company beat second-quarter profit estimates on Wednesday, fueled by soaring prices of crop nutrients which more than offset higher natural gas costs and lower sales volumes. However, the fertilizer producer lowered its full-year adjusted profit forecast as it expects higher natural gas costs to hurt its nitrogen business. Nutrien said it now expects 2022 adjusted earnings between $15.80 and $17.80 per share, compared with its previous expectation of $16.20 to $18.70. Net earnings for the reported quarter more than tripled to a record $3.60 billion, or $6.51 a share.

Sun Life Financial Inc: Canada’s second-biggest life insurer on Wednesday comfortably beat analysts’ estimates for second-quarter core profit, which rose slightly from a year earlier as higher earnings in Canada helped offset a decline in profits from its wealth management unit. Underlying profit was C$892 million, or C$1.52 a share, in the second quarter, from C$883 million, or C$1.50, a year earlier. Analysts had expected profit of C$1.39 a share. Core earnings in Canada rose 19%, helped by business growth and greater insurance sales. That helped offset declines in other units, particularly wealth management, where underlying profit decreased 13% as global stock market woes weighed on its equities-focused MFS Investment Management business.

Thomson Reuters Corp: The news and information company reported higher second-quarter operating profit and raised its full year revenue forecast. The parent company of Reuters News reported adjusted earnings of 60 cents a share. Analysts, on average, had expected 53 cents a share. Total revenues rose 5% in the quarter to $1.61 billion, matching Wall Street estimates.

ECONOMIC EVENTS (EST)

0815 Reserve assets total for July: Prior $106,282 mln

0830 Building permits mm for June: Expected -1.5%; Prior 2.3%

0830 Trade balance for June: Expected C$4.80 bln; Prior C$5.32 bln

0830 Exports for June: Prior C$68.44 bln

0830 Imports for June: Prior C$63.11 bln

COMPANIES REPORTING

August 4:

BCE Inc: Expected Q2 earnings of 84 Canadian cents per share

Bombardier Inc: Expected Q2 loss of 49 cents per share

Canaccord Genuity Group Inc: Expected Q1 earnings of 31 Canadian cents per share

Cascades Inc: Expected Q2 earnings of 8 Canadian cents per share

Enerplus Corp: Expected Q2 earnings of 83 Canadian cents per share

First Majestic Silver Corp: Expected Q2 earnings of 2 cents per share

Gildan Activewear Inc: Expected Q2 earnings of 78 cents per share

Home Capital Group Inc: Expected Q2 earnings of C$1.05 per share

IGM Financial Inc: Expected Q2 earnings of 92 Canadian cents per share

Interfor Corp: Expected Q2 earnings of C$4.32 per share

Jamieson Wellness Inc: Expected Q2 earnings of 30 Canadian cents per share

Keyera Corp: Expected Q2 earnings of 52 Canadian cents per share

Labrador Iron Ore Royalty Corp: Expected Q2 earnings of C$1.30 per share

Lightspeed Commerce Inc: Expected Q1 loss of 14 cents per share

Maple Leaf Foods Inc: Expected Q2 earnings of 26 Canadian cents per share

Open Text Corp: Expected Q4 earnings of 78 cents per share

Pembina Pipeline Corp: Expected Q2 earnings of 65 Canadian cents per share

Quebecor Inc: Expected Q2 earnings of 68 Canadian cents per share

Ritchie Bros Auctioneers Inc: Expected Q2 earnings of 61 cents per share

Saputo Inc: Expected Q1 earnings of 29 Canadian cents per share

Snc-Lavalin Group Inc: Expected Q2 earnings of 33 Canadian cents per share

Suncor Energy Inc: Expected Q2 earnings of C$2.56 per share

Thomson Reuters Corp: Expected Q2 earnings of 53 cents per share

Trisura Group Ltd: Expected Q2 earnings of 39 Canadian cents per share

Turquoise Hill Resources Ltd: Expected Q2 earnings of 36 cents per share

CORPORATE EVENTS (EST)

0800 BCE Inc: Q2 earnings conference call

0800 Bombardier Inc: Q2 earnings conference call

0800 Home Capital Group Inc: Q2 earnings conference call

0800 Lightspeed Commerce Inc: Q1 earnings conference call

0800 Maple Leaf Foods Inc: Q2 earnings conference call

0830 Gildan Activewear Inc: Q2 earnings conference call

0830 Iamgold Corp: Q2 earnings conference call

0830 Snc-Lavalin Group Inc: Q2 earnings conference call

0830 Thomson Reuters Corp: Q2 earnings conference call

0900 Innergex Renewable Energy Inc: Q2 earnings conference call

0900 LifeWorks Inc: Shareholders Meeting

1000 Keyera Corp: Q2 earnings conference call

1000 Nutrien Ltd: Q2 earnings conference call

1000 Saputo Inc: Annual Shareholders Meeting

1000 Sun Life Financial Inc: Q2 earnings conference call

1030 Parex Resources Inc: Q2 earnings conference call

1100 Lightspeed Commerce Inc: Annual Shareholders Meeting

1100 Quebecor Inc: Q2 earnings conference call

1200 Cascades Inc: Q2 earnings conference call

1300 B2Gold Corp: Q2 earnings conference call

1330 Saputo Inc: Q1 earnings conference call

1430 Great-West Lifeco Inc: Q2 earnings conference call

1700 Jamieson Wellness Inc: Q2 earnings conference call

1700 Open Text Corp: Q4 earnings conference call

EX-DIVIDENDS

No major ex-divs for the day.

No major ex-divs for the day.

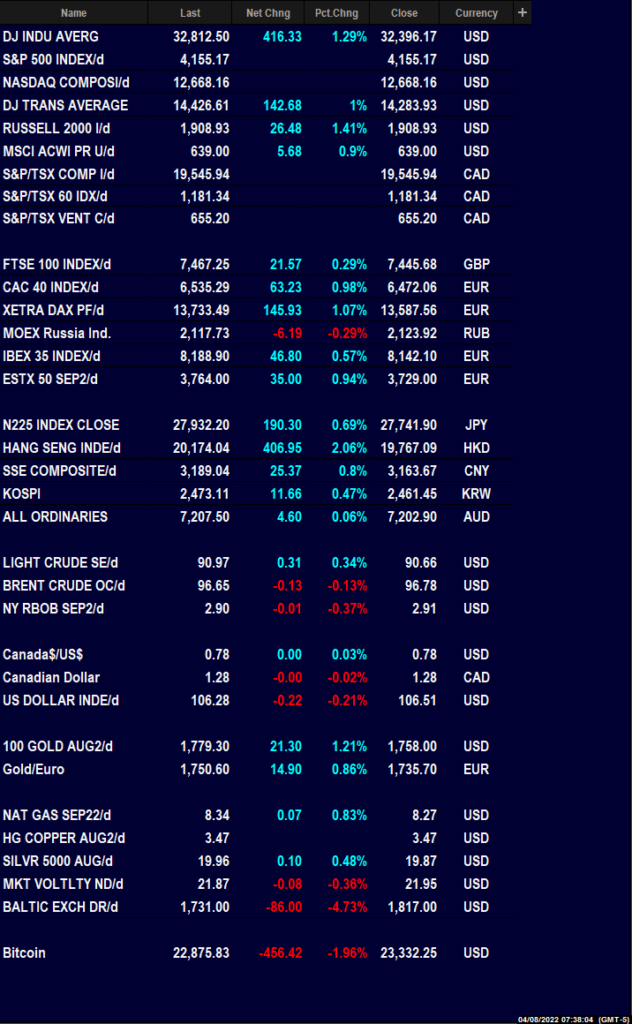

WORLD MARKETS

(07:38 EST)

US CHATTER

PRE-OPEN

US Futures were in the green as worries over the visit of U.S. House of Representatives Speaker Nancy Pelosi to Taiwan eased. In Asian markets, Japan’s Nikkei and China’s stocksended higher. European shares rose following strong corporate results. Gold prices strengthened, and the dollar edged lower. Oil prices rose as the market weighed tight supply against demand fears. Trade deficit and initial jobless claims data are scheduled for release later in the day.

COMPANIES & NEWS

China fires missiles into waters off Taiwan in largest ever drills

China fired multiple missiles around Taiwan, launching unprecedented military drills a day after a visit by U.S. House of Representatives Speaker Nancy Pelosi to the self-ruled island that Beijing regards as its sovereign territory.

Alibaba Group Holding Ltd: The company beat market expectations for revenue in the quarter ending late June, even though growth was flat for the first time ever due to the impact of COVID-19 lockdown. Revenue stood at 205.56 billion yuan in the quarter, compared to analysts’ average expectation of 203.19 billion yuan. Net income attributable to ordinary shareholders for the quarter ended June 30 was 22.74 billion yuan, compared to 45.14 billion yuan, a year earlier.

APA Corp, Marathon Oil Corp & Ovintiv Inc: U.S. shale producers continued a streak of returning more cash to shareholders this week on the back of higher oil prices, despite criticism from lawmakers and other officials that they are reaping excessive profits at the expense of consumers. Marathon Oil said it returned some $816 million to shareholders during the quarter, while rival Ovintiv returned roughly $200 million during the second quarter and said it expects to almost double that during the current quarter. APA reported a second-quarter profit that nearly tripled. Net income rose to $926 million, or $2.71 a share, in the quarter, from $316 million, or 82 cents per share, a year earlier. Ovintiv reported after-tax earnings of $1.36 billion, or $5.21 per share, blowing past Wall Street estimates of $2.82 per share. Marathon Oil reported adjusted net income of $934 million, or 1.32 cents per share, topping analysts’ forecast of $1.26.

Apollo Global Management Inc: The company reported a 13% rise in second-quarter earnings, as income from its annuities provider Athene more than compensated for a decline in asset sales amid a slowdown in dealmaking. Apollo recorded an adjusted net income of $566 million in the three months to June 30, up from $501.8 million a year ago. This missed the average analyst estimate of $655.5 million of adjusted net income. For its quarterly fund performance, Apollo said its private equity portfolio depreciated by 4.9%. Its corporate credit and structured credit funds fell 4.1% and 5.3%, respectively.

Booking Holdings Inc: The online travel agency said growth moderated at the start of the current quarter as global flight cancellations and long waits at airports deterred pandemic-weary travelers. Shares of the company fell in the extended trade, highlighting higher hopes from investors on capturing demand for what is expected to be a blockbuster summer travel season. The company, which reported a 57% increase in gross travel bookings, saw higher international reservations as consumers traveled to their favorite tourist spots in Europe and North America. Revenue for the quarter ended June 30 rose to $4.29 billion, but missed analysts’ estimate of $4.32 billion.

Cigna Corp: The company joined peers in raising its annual profit forecast after its quarterly earnings beat estimates, as a slow recovery in non-urgent medical procedures helps insurers rein in medical expenses.The insurer now expects full-year adjusted earnings of at least $22.90 per share, compared with its previous forecast of $22.60 per share. Quarterly net income attributable to shareholders rose more than 6% to $1.56 billion, or $4.90 per share.

EBay Inc: The company beat second-quarter earnings estimates on Wednesday as the e-commerce company’s focus on selling luxury products tempered the hit from a slowdown in consumer spending and weakness in some European markets. The company forecast a fall in current-quarter revenue but the figure still came in above Wall Street targets. It maintained annual sales estimates at $9.6 billion to $9.9 billion. The company lowered its full-year guidance for gross merchandise value (GMV) to between $72.7 billion and $74.7 billion, from $73.2 billion to $75.2 billion earlier. GMV, a key industry gauge, is the total value of goods sold on the marketplace.

Eli Lilly and Co: The company cut its full-year profit forecast for the second time after reporting a near one-third slump in quarterly profit, hurt by lower prices of insulin and competition for its cancer drug, Alimta. Eli Lilly cut its 2022 adjusted profit forecast to $7.90 to $8.05 per share from $8.15 to $8.30 per share announced in April. Lilly’s net income fell to $952.5 million, or $1.05 per share, in the second quarter ended June 30, from $1.39 billion, or $1.53 per share, a year earlier. Separately, the company said on Wednesday it plans to make its COVID-19 antibody drug commercially available to U.S. states as well as hospitals and other healthcare providers from August.

MercadoLibre Inc: The South American e-commerce giant reported on Wednesday that its second-quarter net income rose 79.8% year-on-year, beating earnings forecasts. The company, present in 18 countries including Brazil, Mexico and Colombia, reported a net income for the three-month period of $123 million, beating a Refinitiv forecast of $98.9 million. The company’s net revenue rose 56.5% in constant currency and 52.5% in dollars to $2.6 billion as it registered growth in revenues from its commerce and fintech sectors.

MetLife Inc: The U.S. insurer reported a 22% fall in quarterly profit on Wednesday as weaker investment returns offset gains from rising premiums. Overall net investment income fell by 32% to $3.58 billion, hurt by changes in the estimated fair value of certain securities. That led to a 16% fall in total revenues to $15.56 billion in the three months ended June 30. Adjusted earnings of the insurer’s Latin America business saw a 175% jump, however, partially offsetting a 13% decline in its U.S. business and a 26% slump in Asia.

Plains All American Pipeline LP: The company on Wednesday raised its 2022 profit forecast for the second time this year, and said it expects strong demand on its pipelines carrying U.S. shale oil to the Gulf Coast. The pipeline operator increased full-year adjusted earnings guidance by $100 million to about $2.38 billion, as it expects higher crude and natural gas liquids volumes. Plains’ adjusted second quarter net income allocated to common unitholders rose 29% to $210 million.

Toyota Motor Corp: The company’s profit slumped a worse-than-expected 42% in its first quarter as the Japanese automaker was squeezed between supply constraints and rising costs. Operating profit for the three months ended June 30 sank to 578.66 billion yen from 997.4 billion yen in the same period a year ago, Toyota said, capping a tough period. The automaker said rising material prices cost it 315 billion yen. Toyota lifted its full-year net profit outlook by 4% to 2.36 trillion yen, helped by the weakness of the yen, which means sales booked in overseas currencies become more valuable.

Boeing Co: The Federal Aviation Administration’s acting chief will meet with FAA safety inspectors in South Carolina before determining whether Boeing can resume deliveries of its 787 Dreamliner after production issues prompted the planemaker to stop deliveries in May 2021, an FAA spokesman said. The purpose of acting Administrator Billy Nolen’s visit “is to ensure that the FAA is satisfied that Boeing has taken the appropriate steps to improve manufacturing quality and to guarantee the autonomy of workers who ensure regulatory compliance on the company’s assembly lines,” the FAA said.

Citigroup Inc: The company said its total exposure to Russia rose by $500 million in the second quarter due to a rise in the value of the rouble. The Wall Street bank disclosed $8.4 billion in Russia exposure as of June 30, compared with $7.9 billion at the end of the first quarter. Citi said it had cut down on loans and cash on deposits in the country, particularly those from its institutional clients group, but that was offset by the rouble’s more than 40% surge in the quarter.

Occidental Petroleum Corp: The company plans to use the bonanza from high oil and gas prices to accelerate debt payments and cash distribution to shareholders but will not raise oil production, Chief Executive Vicki Hollub said on Wednesday. “We don’t feel the need to grow production until we get beyond that point,” Hollub told analysts on a webcast to discuss second quarter earnings. “Because we feel like one of the best values right now is investment in our own stock.” The Permian basin this year should deliver around 521,000 barrels of oil equivalent per day (boed) for the company, from around 532,000 boed projected in May, it said.

Walmart Inc: The company is cutting hundreds of corporate roles in a restructuring effort, the Wall Street Journal reported on Wednesday, citing people familiar with the matter. Around 200 jobs are being cut, the WSJ said, adding that the retailer notified employees in its Bentonville, Arkansas headquarters and other corporate offices of its restructuring move. “We’re updating our structure and evolving select roles to provide clarity and better position the company for a strong future,” Walmart spokesperson Anne Hatfield told Reuters in an emailed statement. The company is also investing and creating jobs in eCommerce, technology, health & wellness sectors, she said.

ECONOMIC EVENTS (EST)

0830 International trade for June: Expected -$80.1 bln; Prior -$85.6 bln

0830 Goods trade balance (R) for June: Prior -$98.18 bln

0830 Initial jobless claims: Expected 259,000; Prior 256,000

0830 Jobless claims 4-week average: Prior 249,250

0830 Continued jobless claims: Expected 1.370 mln; Prior 1.359 mln

COMPANIES REPORTING

AES Corp: Expected Q2 earnings of 31 cents per share

Alliant Energy Corp: Expected Q2 earnings of 58 cents per share

Ameren Corp: Expected Q2 earnings of 83 cents per share

Amgen Inc: Expected Q2 earnings of $4.40 per share

Consolidated Edison Inc: Expected Q2 earnings of 59 cents per share

Corteva Inc: Expected Q2 earnings of $1.47 per share

EOG Resources Inc: Expected Q2 earnings of $2.63 per share

Expedia Group Inc: Expected Q2 earnings of $1.56 per share

Huntington Ingalls Industries Inc: Expected Q2 earnings of $3.35 per share

Intercontinental Exchange Inc: Expected Q2 earnings of $1.27 per share

Kellogg Co: Expected Q2 earnings of $1.05 per share

Live Nation Entertainment Inc: Expected Q2 earnings of 51 cents per share

Monster Beverage Corp: Expected Q2 earnings of 70 cents per share

Motorola Solutions Inc: Expected Q2 earnings of $1.87 per share

NortonLifeLock Inc: Expected Q1 earnings of 43 cents per share

NRG Energy Inc: Expected Q2 earnings of 65 cents per share

Parker-Hannifin Corp: Expected Q4 earnings of $4.67 per share

Public Storage: Expected Q2 earnings of $2.54 per share

Regency Centers Corp: Expected Q2 earnings of 45 cents per share

Republic Services Inc: Expected Q2 earnings of $1.18 per share

Sempra Energy: Expected Q2 earnings of $1.76 per share

Skyworks Solutions Inc: Expected Q3 earnings of $2.35 per share

Ventas Inc: Expected Q2 earnings of 01 cents per share

Vertex Pharmaceuticals Inc: Expected Q2 earnings of $3.48 per share

Warner Bros Discovery Inc: Expected Q2 earnings of 01 cents per share

EX-DIVIDENDS

CMS Energy Corp: Amount $0.46

FirstEnergy Corp: Amount $0.39

Hexcel Corp: Amount $0.10

Howmet Aerospace Inc: Amount $0.02

Intel Corp: Amount $0.36

J B Hunt Transport Services Inc: Amount $0.40

Kinetik Holdings Inc: Amount $0.75

Lamb Weston Holdings Inc: Amount $0.24

Pinnacle Financial Partners Inc: Amount $0.22

Sirius XM Holdings Inc: Amount $0.02

Wells Fargo & Co: Amount $0.30

China fires missiles into waters off Taiwan in largest ever drills

China fired multiple missiles around Taiwan, launching unprecedented military drills a day after a visit by U.S. House of Representatives Speaker Nancy Pelosi to the self-ruled island that Beijing regards as its sovereign territory.

Alibaba Group Holding Ltd: The company beat market expectations for revenue in the quarter ending late June, even though growth was flat for the first time ever due to the impact of COVID-19 lockdown. Revenue stood at 205.56 billion yuan in the quarter, compared to analysts’ average expectation of 203.19 billion yuan. Net income attributable to ordinary shareholders for the quarter ended June 30 was 22.74 billion yuan, compared to 45.14 billion yuan, a year earlier.

APA Corp, Marathon Oil Corp & Ovintiv Inc: U.S. shale producers continued a streak of returning more cash to shareholders this week on the back of higher oil prices, despite criticism from lawmakers and other officials that they are reaping excessive profits at the expense of consumers. Marathon Oil said it returned some $816 million to shareholders during the quarter, while rival Ovintiv returned roughly $200 million during the second quarter and said it expects to almost double that during the current quarter. APA reported a second-quarter profit that nearly tripled. Net income rose to $926 million, or $2.71 a share, in the quarter, from $316 million, or 82 cents per share, a year earlier. Ovintiv reported after-tax earnings of $1.36 billion, or $5.21 per share, blowing past Wall Street estimates of $2.82 per share. Marathon Oil reported adjusted net income of $934 million, or 1.32 cents per share, topping analysts’ forecast of $1.26.

Apollo Global Management Inc: The company reported a 13% rise in second-quarter earnings, as income from its annuities provider Athene more than compensated for a decline in asset sales amid a slowdown in dealmaking. Apollo recorded an adjusted net income of $566 million in the three months to June 30, up from $501.8 million a year ago. This missed the average analyst estimate of $655.5 million of adjusted net income. For its quarterly fund performance, Apollo said its private equity portfolio depreciated by 4.9%. Its corporate credit and structured credit funds fell 4.1% and 5.3%, respectively.

Booking Holdings Inc: The online travel agency said growth moderated at the start of the current quarter as global flight cancellations and long waits at airports deterred pandemic-weary travelers. Shares of the company fell in the extended trade, highlighting higher hopes from investors on capturing demand for what is expected to be a blockbuster summer travel season. The company, which reported a 57% increase in gross travel bookings, saw higher international reservations as consumers traveled to their favorite tourist spots in Europe and North America. Revenue for the quarter ended June 30 rose to $4.29 billion, but missed analysts’ estimate of $4.32 billion.

Cigna Corp: The company joined peers in raising its annual profit forecast after its quarterly earnings beat estimates, as a slow recovery in non-urgent medical procedures helps insurers rein in medical expenses.The insurer now expects full-year adjusted earnings of at least $22.90 per share, compared with its previous forecast of $22.60 per share. Quarterly net income attributable to shareholders rose more than 6% to $1.56 billion, or $4.90 per share.

EBay Inc: The company beat second-quarter earnings estimates on Wednesday as the e-commerce company’s focus on selling luxury products tempered the hit from a slowdown in consumer spending and weakness in some European markets. The company forecast a fall in current-quarter revenue but the figure still came in above Wall Street targets. It maintained annual sales estimates at $9.6 billion to $9.9 billion. The company lowered its full-year guidance for gross merchandise value (GMV) to between $72.7 billion and $74.7 billion, from $73.2 billion to $75.2 billion earlier. GMV, a key industry gauge, is the total value of goods sold on the marketplace.

Eli Lilly and Co: The company cut its full-year profit forecast for the second time after reporting a near one-third slump in quarterly profit, hurt by lower prices of insulin and competition for its cancer drug, Alimta. Eli Lilly cut its 2022 adjusted profit forecast to $7.90 to $8.05 per share from $8.15 to $8.30 per share announced in April. Lilly’s net income fell to $952.5 million, or $1.05 per share, in the second quarter ended June 30, from $1.39 billion, or $1.53 per share, a year earlier. Separately, the company said on Wednesday it plans to make its COVID-19 antibody drug commercially available to U.S. states as well as hospitals and other healthcare providers from August.

MercadoLibre Inc: The South American e-commerce giant reported on Wednesday that its second-quarter net income rose 79.8% year-on-year, beating earnings forecasts. The company, present in 18 countries including Brazil, Mexico and Colombia, reported a net income for the three-month period of $123 million, beating a Refinitiv forecast of $98.9 million. The company’s net revenue rose 56.5% in constant currency and 52.5% in dollars to $2.6 billion as it registered growth in revenues from its commerce and fintech sectors.

MetLife Inc: The U.S. insurer reported a 22% fall in quarterly profit on Wednesday as weaker investment returns offset gains from rising premiums. Overall net investment income fell by 32% to $3.58 billion, hurt by changes in the estimated fair value of certain securities. That led to a 16% fall in total revenues to $15.56 billion in the three months ended June 30. Adjusted earnings of the insurer’s Latin America business saw a 175% jump, however, partially offsetting a 13% decline in its U.S. business and a 26% slump in Asia.

Plains All American Pipeline LP: The company on Wednesday raised its 2022 profit forecast for the second time this year, and said it expects strong demand on its pipelines carrying U.S. shale oil to the Gulf Coast. The pipeline operator increased full-year adjusted earnings guidance by $100 million to about $2.38 billion, as it expects higher crude and natural gas liquids volumes. Plains’ adjusted second quarter net income allocated to common unitholders rose 29% to $210 million.

Toyota Motor Corp: The company’s profit slumped a worse-than-expected 42% in its first quarter as the Japanese automaker was squeezed between supply constraints and rising costs. Operating profit for the three months ended June 30 sank to 578.66 billion yen from 997.4 billion yen in the same period a year ago, Toyota said, capping a tough period. The automaker said rising material prices cost it 315 billion yen. Toyota lifted its full-year net profit outlook by 4% to 2.36 trillion yen, helped by the weakness of the yen, which means sales booked in overseas currencies become more valuable.

Boeing Co: The Federal Aviation Administration’s acting chief will meet with FAA safety inspectors in South Carolina before determining whether Boeing can resume deliveries of its 787 Dreamliner after production issues prompted the planemaker to stop deliveries in May 2021, an FAA spokesman said. The purpose of acting Administrator Billy Nolen’s visit “is to ensure that the FAA is satisfied that Boeing has taken the appropriate steps to improve manufacturing quality and to guarantee the autonomy of workers who ensure regulatory compliance on the company’s assembly lines,” the FAA said.

Citigroup Inc: The company said its total exposure to Russia rose by $500 million in the second quarter due to a rise in the value of the rouble. The Wall Street bank disclosed $8.4 billion in Russia exposure as of June 30, compared with $7.9 billion at the end of the first quarter. Citi said it had cut down on loans and cash on deposits in the country, particularly those from its institutional clients group, but that was offset by the rouble’s more than 40% surge in the quarter.

Occidental Petroleum Corp: The company plans to use the bonanza from high oil and gas prices to accelerate debt payments and cash distribution to shareholders but will not raise oil production, Chief Executive Vicki Hollub said on Wednesday. “We don’t feel the need to grow production until we get beyond that point,” Hollub told analysts on a webcast to discuss second quarter earnings. “Because we feel like one of the best values right now is investment in our own stock.” The Permian basin this year should deliver around 521,000 barrels of oil equivalent per day (boed) for the company, from around 532,000 boed projected in May, it said.

Walmart Inc: The company is cutting hundreds of corporate roles in a restructuring effort, the Wall Street Journal reported on Wednesday, citing people familiar with the matter. Around 200 jobs are being cut, the WSJ said, adding that the retailer notified employees in its Bentonville, Arkansas headquarters and other corporate offices of its restructuring move. “We’re updating our structure and evolving select roles to provide clarity and better position the company for a strong future,” Walmart spokesperson Anne Hatfield told Reuters in an emailed statement. The company is also investing and creating jobs in eCommerce, technology, health & wellness sectors, she said.

ECONOMIC EVENTS (EST)

0830 International trade for June: Expected -$80.1 bln; Prior -$85.6 bln

0830 Goods trade balance (R) for June: Prior -$98.18 bln

0830 Initial jobless claims: Expected 259,000; Prior 256,000

0830 Jobless claims 4-week average: Prior 249,250

0830 Continued jobless claims: Expected 1.370 mln; Prior 1.359 mln

COMPANIES REPORTING

AES Corp: Expected Q2 earnings of 31 cents per share

Alliant Energy Corp: Expected Q2 earnings of 58 cents per share

Ameren Corp: Expected Q2 earnings of 83 cents per share

Amgen Inc: Expected Q2 earnings of $4.40 per share

Consolidated Edison Inc: Expected Q2 earnings of 59 cents per share

Corteva Inc: Expected Q2 earnings of $1.47 per share

EOG Resources Inc: Expected Q2 earnings of $2.63 per share

Expedia Group Inc: Expected Q2 earnings of $1.56 per share

Huntington Ingalls Industries Inc: Expected Q2 earnings of $3.35 per share

Intercontinental Exchange Inc: Expected Q2 earnings of $1.27 per share

Kellogg Co: Expected Q2 earnings of $1.05 per share

Live Nation Entertainment Inc: Expected Q2 earnings of 51 cents per share

Monster Beverage Corp: Expected Q2 earnings of 70 cents per share

Motorola Solutions Inc: Expected Q2 earnings of $1.87 per share

NortonLifeLock Inc: Expected Q1 earnings of 43 cents per share

NRG Energy Inc: Expected Q2 earnings of 65 cents per share

Parker-Hannifin Corp: Expected Q4 earnings of $4.67 per share

Public Storage: Expected Q2 earnings of $2.54 per share

Regency Centers Corp: Expected Q2 earnings of 45 cents per share

Republic Services Inc: Expected Q2 earnings of $1.18 per share

Sempra Energy: Expected Q2 earnings of $1.76 per share

Skyworks Solutions Inc: Expected Q3 earnings of $2.35 per share

Ventas Inc: Expected Q2 earnings of 01 cents per share

Vertex Pharmaceuticals Inc: Expected Q2 earnings of $3.48 per share

Warner Bros Discovery Inc: Expected Q2 earnings of 01 cents per share

EX-DIVIDENDS

CMS Energy Corp: Amount $0.46

FirstEnergy Corp: Amount $0.39

Hexcel Corp: Amount $0.10

Howmet Aerospace Inc: Amount $0.02

Intel Corp: Amount $0.36

J B Hunt Transport Services Inc: Amount $0.40

Kinetik Holdings Inc: Amount $0.75

Lamb Weston Holdings Inc: Amount $0.24

Pinnacle Financial Partners Inc: Amount $0.22

Sirius XM Holdings Inc: Amount $0.02

Wells Fargo & Co: Amount $0.30

EUROPE, ASIA CHATTER

MARKET VIEW (04:30 GMT)

S&P 500 Index Mini Futures: 4,153.00; down 0.08%; 3.25 points

DJIA Mini Futures: 32,764.00; down 0.02%; 6 points

Nikkei: 27,902.26; up 0.58%; 160.36 points

MSCI Asia, Ex-JP: 520.81; up 0.51%; 2.63 points

EUR/USD: $1.0164; down 0.01%; 0.0001 point

GBP/USD: $1.2155; up 0.08%; 0.0010 point

USD/JPY: 133.70 yen; down 0.13%; 0.18 point

Spot Gold: $1,770.96; up 0.34%; $6.06

U.S. Crude: $90.89; up 0.25%; $0.23

Brent Crude: $96.91; up 0.13%; $0.13

10-Yr U.S. Treasury Yield: 2.7155%; down 0.031 point

10-Yr Bund Yield: 0.8675%; up 0.006 point

DJIA Mini Futures: 32,764.00; down 0.02%; 6 points

Nikkei: 27,902.26; up 0.58%; 160.36 points

MSCI Asia, Ex-JP: 520.81; up 0.51%; 2.63 points

EUR/USD: $1.0164; down 0.01%; 0.0001 point

GBP/USD: $1.2155; up 0.08%; 0.0010 point

USD/JPY: 133.70 yen; down 0.13%; 0.18 point

Spot Gold: $1,770.96; up 0.34%; $6.06

U.S. Crude: $90.89; up 0.25%; $0.23

Brent Crude: $96.91; up 0.13%; $0.13

10-Yr U.S. Treasury Yield: 2.7155%; down 0.031 point

10-Yr Bund Yield: 0.8675%; up 0.006 point

Euro STOXX 50 futures were up 6 points at 3,735.0, FTSE futures added 8.5 points to 7,399.5, and German DAX futures were higher 47 points at 13,625.0, by 0430 GMT.

Asian stocks rose, taking cues from a strong rally on Wall Street after robust economic data and upbeat corporate guidance boosted investor appetite.

Oil prices rose as supply concerns triggered a rebound from multi-month lows plumbed in the previous session after U.S. data signalled weak fuel demand.

COMPANIES & NEWS

Asian stocks rose, taking cues from a strong rally on Wall Street after robust economic data and upbeat corporate guidance boosted investor appetite.

Oil prices rose as supply concerns triggered a rebound from multi-month lows plumbed in the previous session after U.S. data signalled weak fuel demand.

COMPANIES & NEWS

| The Bank of England is expected to raise interest rates by the most since 1995, even as the risks of a recession mount, in an attempt to stop a surge in inflation from becoming embedded in Britain’s economy. |

Federal Reserve officials voiced their determination again on Wednesday to rein in high inflation, although one noted a half-percentage-point hike in the U.S. central bank’s key interest rate next month might be enough to march toward that goal.

Suspected drones flew over outlying Taiwanese islands and hackers attacked its defence ministry website, authorities in Taipei said, a day after a visit by U.S. House of Representatives Speaker Nancy Pelosi that outraged China.

Gazprom will receive 50% of a new Russian entity replacing the Sakhalin Energy liquefied natural gas (LNG) project, Russian news agencies reported on Wednesday, citing a government decree.

Telecom Italia (TIM) has trimmed its expected profit drop for 2022 to lift its outlook on the back of its second-quarter results, helped by cost cutting and the contribution from the company’s Brazilian subsidiary.

Airbus has revoked its entire outstanding order from Qatar Airways for A350 jets, severing all new jetliner business with the Gulf carrier in a dramatic new twist to a dispute clouding World Cup preparations, two industry sources said.

COMPANY ANNOUNCEMENTS

Adecco Group AG Q2 2022 Earnings Call

Adidas AG HY 2022 Earnings Release

Bayer AG Q2 2022 Earnings Release

Beiersdorf AG HY 2022 Earnings Release

ConvaTec Group PLC HY 2022 Earnings Release

Credit Agricole SA HY 2022 Earnings Call

Deutsche Lufthansa AG Q2 2022 Earnings Release

Glencore PLC HY 2022 Earnings Release

Hikma Pharmaceuticals PLC HY 2022 Earnings Call

Informa PLC HY 2022 Earnings Release

ING Groep NV Q2 2022 Earnings Call

Investec PLC Annual Shareholders Meeting

Lanxess AG Q2 2022 Earnings Call

Meggitt PLC HY 2022 Earnings Release

Merck KGaA Q2 2022 Earnings Call

Rolls-Royce Holdings PLC HY 2022 Earnings Release

SES SA Q2 2022 Earnings Call

Swisscom AG Q2 2022 Earnings Release

Tenaris SA Q2 2022 Earnings Call

Telecom Italia SpA Q2 2022 Earnings Release

Tritax Big Box Reit PLC HY 2022 Earnings Call

United Internet AG Q2 2022 Earnings Call

VAT Group AG HY 2022 Earnings Call

voestalpine AG Q1 2023 Earnings Release

Zalando SE Q2 2022 Earnings Release

ECONOMIC EVENTS (GMT)

0600 Germany Industrial Orders mm for June: Expected -0.8%; Prior 0.1%

0600 Germany Manufacturing O/P Current Price SA for June: Prior 8.8%

0600 Germany Consumer Goods SA for June: Prior 135.2

0730 Euro Zone S&P Global Construction PMI for July: Prior 47.0

0730 Germany S&P Global Construction PMI for July: Prior 45.9

0730 France S&P Global Construction PMI for July: Prior 46.4

0730 Italy S&P Global Construction PMI for July: Prior 50.4

0830 United Kingdom All-Sector PMI for July: Prior 53.6

0830 United Kingdom S&P Global/CIPS Construction PMI for July: Expected 52.0; Prior 52.6

1100 United Kingdom BOE MPC Vote Hike for August: Expected 9; Prior 9

1100 United Kingdom BOE MPC Vote Unchanged for August: Expected 0; Prior 0

1100 United Kingdom BOE MPC Vote Cut for August: Expected 0; Prior 0

1100 United Kingdom BOE Bank Rate for August: Expected 1.75%; Prior 1.25%

Source (not limited too): Reuters, CNBC, Globe & Mail, InvestorIntel Corp, Kitco, Refinitiv.